One of the strongest economic sectors in the United States at the beginning of the pandemic was the housing market but, just like all other sectors, it appears that it’s now slowing down.

The signs that this is the case have caused increased concern for those who were planning on investing in real estate.

More precisely, the looming threat of another recession, increased rates as well as the Federal Reserve’s announcement about more hikes, have led to buyers but also builders to press pause on their plans and projects.

Investors seem to be looking to short the market as well, fearing that another housing crash like the one in 2008 would once again take place.

Sure enough, reports say that the one who predicted the initial housing crash at the time, Michael Burry, tweeted back in July that the housing market is in “free fall.”

Housing market in free fall.

Most people don’t know you can short the housing market with ETFs but you can.

— Michael Burry Stock Tracker ♟ (@burrytracker) July 20, 2022

Burry also supposedly advised Investors to short it. But what does that mean and how can it be done?

One way to short the United States housing market is through inverse exchange-traded funds [ETF], which can provide short exposure to securities tracked by Dow Jones U.S. Real Estate Index or MSCI US IMI Real Estate Index.

The Real Estate Index [REI] is an inverse ETF, designed to “track the performance of real estate investment trusts” but also of different companies investing in real estate directly.

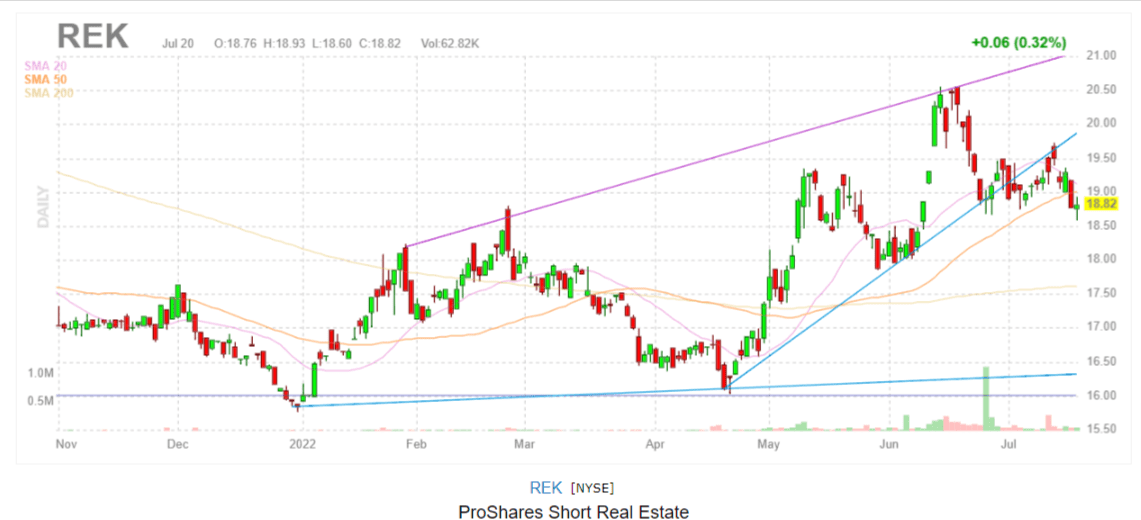

Year to date REK is currently up more than 17 percent with short trends and long term ones staying positive.

According to Finbold, after the home builder stocks drop, less demand appears to be leading the housing market into a downturn.

As a result, treasury yields and borrowing costs are rising for end consumers which seems to be creating a vicious cycle for the housing market in general.

Furthermore, inverse ETFs can perform really well in a bear market as well but at the same time, the overall risk if much bigger when compared to non-inverse ETFs.

The reason is that the former use complex financial instruments such as derivatives and index swaps in order to ensure that short exposure is provided.

In conclusion, inverse ETFs should do quite well if the housing market continues to decline but investors wishing to get short exposure should keep in mind that there is still a risk involved, the results being quite unstable.

Leave a Reply